Proper worker classification prevents costly IRS penalties and legal issues. The key differences between employees and independent contractors involve three main factors: behavioral control, financial control, and relationship type. Employees receive direct oversight and regular wages, while contractors maintain autonomy and handle their own expenses. Misclassification can result in back taxes, fines, and benefit payments. Understanding these distinctions helps businesses maintain compliance and avoid expensive consequences.

Key Takeaways

- Document all business relationships with clear written contracts specifying worker classification, responsibilities, payment terms, and project scope.

- Assess behavioral control by examining who directs work methods, schedules, and training requirements for workers.

- Evaluate financial control through payment structures, business expenses, and whether workers can profit or lose from services.

- Maintain thorough records of tax forms, payments, and supporting documentation for at least four years.

- Review worker classifications regularly and ensure compliance with both federal and state-specific requirements to avoid penalties.

The Real Cost of Worker Misclassification

Worker misclassification creates severe financial consequences for governments and businesses across the United States. Federal revenue losses reached $2.72 billion in 2006, while states like New York reported $175 million in unpaid taxes. Regulatory compliance failures result in severe penalties and fines for employers, including up to 3% of wages and 100% of unpaid FICA taxes.

The impact on workers' benefits and rights is equally significant. Misclassified workers lose access to minimum wage protections, overtime pay, and workers' compensation. They also forfeit health insurance, retirement plans, and unemployment benefits. Studies show 10-30% of employers misclassify workers, affecting millions nationwide. States report alarming numbers, with Pennsylvania identifying 259,000 misclassified employees and Texas finding 34,846 cases between 2010-2012.

Key Factors That Define Worker Status

To prevent misclassification issues, businesses must understand the specific factors that determine worker status. Three primary areas define whether a worker is an employee or independent contractor: Financial Control, Relationship of the Parties, and Behavioral Control.

Financial Control examines how workers are paid, their ability to profit or lose money, and their investment in equipment. The Relationship of the Parties looks at written contracts, benefits, and the permanency of work arrangements. Companies must also evaluate how integral workers are to their core business operations and the degree of autonomy workers maintain. Workers who control their schedules, can work for multiple clients, and market their services independently typically qualify as contractors. Those with less autonomy and deeper integration into company operations often classify as employees.

Behavioral Control: Who Directs the Work?

Behavioral control stands as a crucial factor in determining worker classification. The key distinction lies in who directs how the work gets done. Independent contractors typically maintain autonomy over their work methods, tools, and schedules. They can choose their work location and are not bound to specific workplace requirements.

In contrast, employees face more direct oversight. Their employers often provide detailed instructions, mandatory training, and specific procedures. The presence of behavioral control becomes evident when businesses dictate work methods, conduct regular evaluations, and monitor how tasks are performed. Employee classification is likely when workers must follow set schedules, attend training sessions, or work at designated locations.

The degree of behavioral control exercised by the business helps determine whether a worker qualifies as an employee or independent contractor.

Financial Control: Following the Money Trail

Financial control represents three key aspects in determining worker classification. The first aspect focuses on payment structure, where independent contractors negotiate rates and handle their own invoicing, while employees receive set wages with regular paydays. The second aspect examines financial risks and benefits, with contractors having the potential for profit or loss while employees have stable income. The third aspect involves financial investments and tax obligations.

Independent contractors make significant investments in their business equipment and facilities, whereas employees rely on employer-provided resources. Additionally, contractors must manage their own tax obligations, including self-employment tax and estimated payments. Employers handle tax withholding for employees and contribute to their social security and Medicare taxes. Proper classification based on these financial control factors helps businesses avoid IRS penalties.

Understanding Relationship Dynamics

When determining worker classification, relationship dynamics provide critical indicators of employment status. The level of behavioral control shows whether workers must follow specific instructions or maintain independence in their work methods. The degree of integration reveals if services are merged into core business operations or remain separate.

The type of relationship is evident through contractual agreements and termination rights. Employees typically have ongoing relationships with no end date and can be discharged at will. Independent contractors work under specific contracts with defined completion terms. Additional factors include benefit eligibility and the ability to work with multiple clients. Employees usually receive extensive benefits and work exclusively for one employer, while contractors manage their own benefits and can serve multiple clients simultaneously.

Tax Obligations and Reporting Requirements

Tax obligations differ substantially between employees and independent contractors regarding withholding and reporting deadlines. Employers must withhold taxes and issue W-2 forms for employees, while independent contractors receive 1099-NEC forms and handle their own tax payments. Both types of workers face specific documentation requirements, with employers needing to maintain proper records and meet January 31st filing deadlines for all tax forms.

Withholding and Reporting Deadlines

Filing deadlines and withholding requirements create distinct obligations for employers managing workers. For employees, employers must regularly withhold income taxes, Social Security, and Medicare from wages throughout the year. These withholding requirements include timely deposits to avoid IRS penalties.

The reporting deadlines are strict and specific. Employers must provide W-2 forms to employees by January 31st, documenting all wages and withheld taxes. For independent contractors earning over $600, employers must issue Form 1099-NEC by January 31st. Both forms must also be submitted to the appropriate government agencies by the same date.

Tax obligations differ markedly between worker classifications. While employers handle tax withholdings for employees, independent contractors manage their own tax payments through quarterly estimated payments.

Tax Forms and Filing

Understanding the distinct tax forms and obligations marks a crucial difference between employees and independent contractors. Employees receive W-2 forms from employers, who handle income tax withholding and FICA tax payments. Employers report employee wages to the IRS and provide tax benefits through various deductions.

Independent contractors, however, receive Form 1099-MISC for payments exceeding $600. They must manage their own tax obligations, including self-employment tax of 15.3% and quarterly estimated tax payments. These contractors report business income on Schedule C and self-employment tax on Schedule SE of Form 1040. They bear full responsibility for FICA taxes but can deduct business expenses. While employees benefit from employer-managed tax withholding, independent contractors must maintain detailed records and handle all tax responsibilities independently.

Payment Documentation Requirements

Proper documentation of payments marks a clear distinction between employees and independent contractors. Employers must handle payment documentation requirements differently for each classification. For employees, employers withhold taxes and make regular tax deposits to the IRS. They also match Social Security and Medicare contributions and pay unemployment taxes.

Independent contractors manage their own tax obligations. They handle self-employment taxes and make estimated payments throughout the year. The key differences in payment documentation include:

- Employers withhold taxes for employees but not for contractors

- Contractors receive Form 1099-NEC for payments over $600

- Employees receive W-2 forms for wage reporting

Both classifications require specific record-keeping practices. Employers must maintain accurate wage records for employees. Independent contractors must track their income and business expenses for tax purposes.

Legal Protections and Benefits Analysis

The legal system provides vastly different protections for employees versus independent contractors. Employees receive thorough benefits and legal protections including minimum wage requirements, overtime pay, workers’ compensation, and anti-discrimination safeguards. Independent contractors operate with fewer legal protections but gain greater autonomy in work arrangements, project selection, and contract negotiation. This distinction affects various legal matters, including liability, taxation, and workplace rights. For example, disputes over wrongful termination typically apply to employees but not to independent contractors, who must rely on contract law for recourse. Similarly, legal issues such as selfdefense claims in the bay area may impact workers differently based on their classification, influencing how legal protections are applied in workplace incidents.

Benefits Protected By Law

Legal protections and benefits create fundamental differences between employees and independent contractors. These distinctions impact tax implications, labor law considerations, and liability and insurance differences. Employees receive mandatory protections including minimum wage, overtime pay, and workers' compensation coverage. Independent contractors must secure their own benefits and insurance protection.

Key benefits protected by law for employees include:

- Minimum wage guarantees and overtime compensation at 1.5 times regular pay

- Workers' compensation insurance coverage for work-related injuries

- Unemployment insurance benefits when job loss occurs through no fault of their own

Health insurance, retirement plans, and paid time off are additional benefits often provided to employees. Independent contractors must independently obtain these benefits and manage their own insurance needs. This classification substantially affects both parties' rights and responsibilities under labor laws.

Contractor Rights Vs Employees

Between employees and independent contractors, fundamental legal rights and protections create distinct work relationships. Employees receive extensive legal rights under federal and state labor laws, including protection against discrimination, minimum wage guarantees, and workplace safety regulations. They also benefit from employer-managed tax withholdings and matching contributions.

Independent contractors maintain different legal rights through business contracts, with more limited federal protections. They bear responsibility for their own tax implications, including self-employment taxes and quarterly payments. While contractors gain flexibility in negotiating terms and rates, they lack traditional employee benefits like workers' compensation or unemployment insurance. The distinction impacts how individuals receive payment documentation, with employees receiving W-2 forms and contractors receiving 1099-MISC forms for tax reporting purposes.

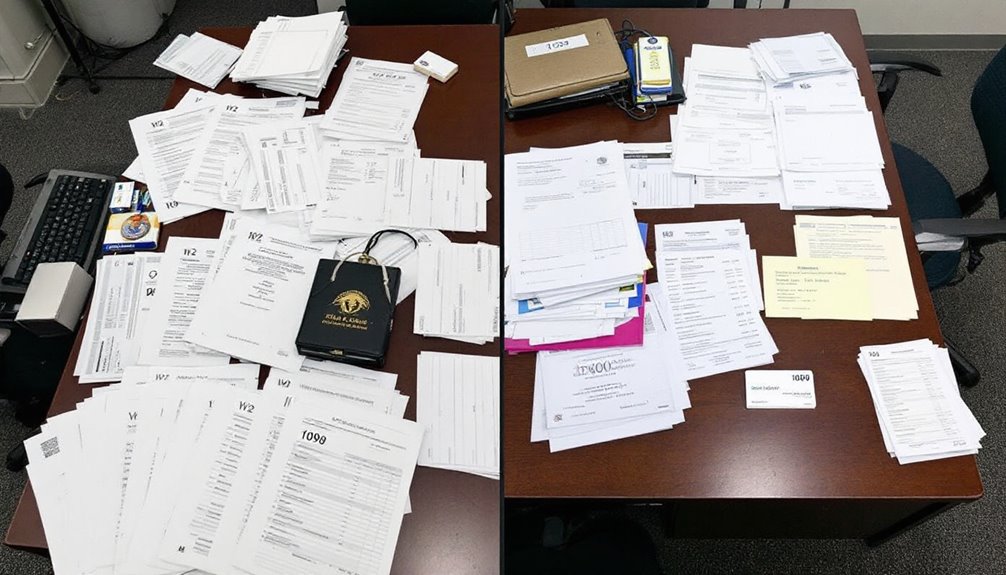

Essential Documentation and Record Keeping

Proper documentation serves as a critical foundation for independent contractor relationships. When managing employee vs. independent contractor classifications, businesses must maintain thorough records to demonstrate compliance with IRS requirements. Essential documentation includes signed contracts, tax forms, and payment records.

Key forms that require careful record keeping include:

- Form W-9 for tax identification information

- Form 1099-NEC for reporting payments over $600

- Independent Contractor Agreements outlining project scope

Companies should store all documentation for at least four years after hiring. This includes business licenses, insurance certificates, and invoices. Regular compliance reviews help verify proper classification status. Creating new contracts for each project helps avoid the appearance of an employer-employee relationship. Maintaining organized records protects businesses during potential IRS audits and demonstrates commitment to proper worker classification.

Steps to Ensure Proper Classification

Building on strong documentation practices, organizations must follow specific steps to correctly classify their workers. Companies should evaluate behavioral control by examining how much direction they give workers about when, where, and how to perform tasks. Next, assess financial control by reviewing who bears business expenses and investment costs. Organizations must then analyze the type of relationship through factors like benefits, contracts, and work permanence.

To avoid IRS penalties related to worker classification, businesses should apply the totality of circumstances approach. This means weighing all factors in the employee vs. independent contractor determination, rather than relying on single elements. Companies should also consider state-specific requirements and regularly review their classification decisions to maintain ongoing compliance with changing regulations.

Frequently Asked Questions

Can a Worker Be Both an Employee and Contractor Simultaneously?

Yes, a worker can be both an employee and contractor for the same company at the same time. This is possible when they perform different types of work. For example, someone might work as an employee during regular hours. Then they might do separate contract work after hours. The work must be clearly different. Each role needs its own agreement. The duties cannot overlap.

How Often Should Businesses Review and Update Worker Classification Status?

Businesses should review worker classifications at least annually. More frequent reviews may be needed when work relationships change substantially. Regular reviews help guarantee compliance with new laws and regulations. Key times for review include contract renewals, role changes, or shifts in work arrangements. The DOL's new rule effective March 11, 2024, makes these reviews especially important. Companies should document all classification decisions and updates.

What Happens if an Independent Contractor Only Works for One Company?

Studies show that nearly 80% of independent contractors who work for a single company are at higher risk of misclassification. Working for one company alone does not automatically make someone an employee. The key factor is control. If the worker maintains independence over how they complete tasks, sets their own schedule, and handles their own business expenses, they can still qualify as an independent contractor despite having only one client.

Are Family Members Treated Differently When Determining Worker Classification Status?

Family members can be subject to different tax rules depending on the business structure. In sole proprietorships, children under 18 working for parents are exempt from certain taxes. However, in corporations or partnerships without parent owners, family members are treated like any other worker. The key factors for classification still apply. The IRS looks at behavioral control, financial control, and relationship type, regardless of family ties.

Can Seasonal or Temporary Workers Qualify as Independent Contractors?

Like migrating birds that return each season, seasonal workers can be either employees or independent contractors. Their classification depends on the nature of work control, not timing. Temporary status alone does not determine contractor status. The IRS looks at key factors like behavioral control, financial control, and relationship type. Most seasonal workers are employees if the business controls their work methods and schedule, provides tools, and manages their tasks.

Conclusion

Worker classification mistakes can trigger catastrophic consequences that could sink even the mightiest companies. Businesses must treat classification decisions like defusing a bomb – one wrong move means explosion. Smart organizations triple-check their worker status determinations, maintain bulletproof documentation, and stay updated on evolving regulations. The cost of getting it wrong is astronomical. The path to safety requires vigilance, precision, and an almost paranoid attention to detail.